Sustainable Finance

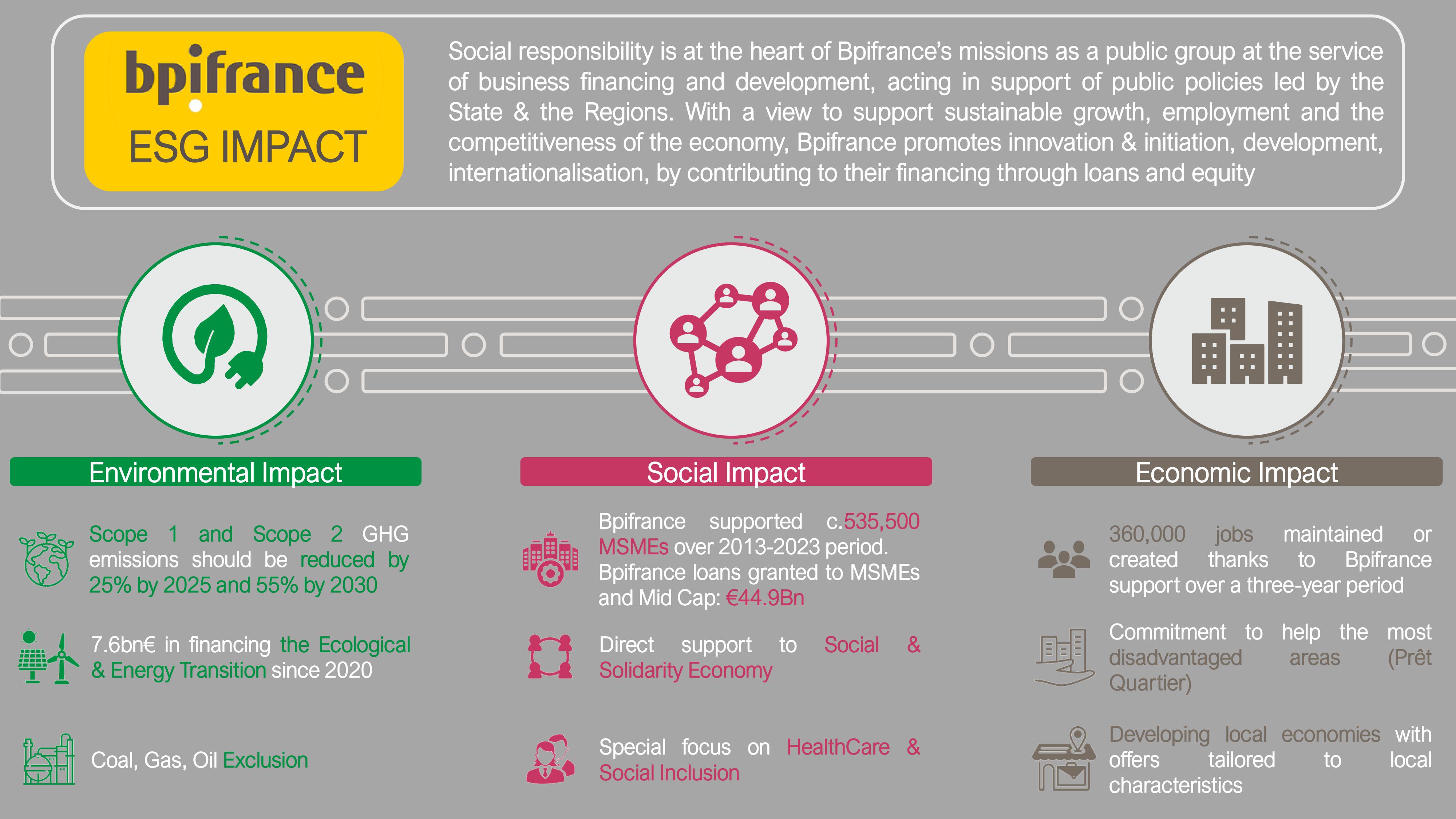

Bpifrance’s ESG Impact

.

A word from the CFO

Dear investors,

As part of Bpifrance’s commitment to sustainability, we are very pleased to present our thematic bonds refinancing program :

As part of Bpifrance’s commitment to sustainability, we are very pleased to present our thematic bonds refinancing program :

- The Covid-19 Response Bond, first of its kind in France, amounted to €1.5 billion in 2020. Through this initiative built around Bpifrance’s commitment to support French Micro, Small & Medium Enterprises, Bpifrance played a strategic role to support the french economy during the crisis. In the aftermath of the pandemic, we are pleased to note that the proceeds of this bond helped to mitigate cash flow difficulties for businesses and provided them with an access to financial services during the Covid-19 economic downturn, thereby alleviating unemployment and promoting job preservation and creation;

- Bpifrance Green Bond program focus on Renewable Energies and offers investors a unique access to french solar and wind projects. Renewable energy financing is one of Bpifrance’s historical activity and the Bpifrance Green Bonds program allows us to bridge the gap between bond issuance and loan origination. Climate emergency has been reinforced into our business model with the «Plan Climat » co-launched with La Banque des Territoires. An ambitious target of €40 billion will be deployed on the 2020-2024 period and will contribute to France’s economic revival. The net proceeds of Bpifrance’s Green Bonds are used to finance and/or refinance, in whole or in part, new or existing medium and long-term loans aiming at financing solar and wind projects.

- In 2023, Bpifrance Green Bond Program has been updated. We added two new categories : Green Building loans and GreenTech loans, in addition to the historic one : RE loans. The 3 pillars of Bpifrance “Plan Climat” are now part of our refinancing program. A 100% alignment with the EU Taxonomy has been assessed by a SPO for the RE loans. Concerning Green Building loans, a step by step approach has been taken to gradually take into consideration all aspects of EU Taxonomy.

- In 2023, Bpifrance launches a Social Financing Program. It has been designed to complement the existing Green Bond Framework and highlight the crucial role of Bpifrance in its social missions. The goal is to further develop the market of sustainable finance in France, especially for the benefit of employment, development of micro-businesses and SMEs, and a particular focus on the unique positioning of Bpifrance: innovation of MSMEs. It is an important part of Bpifrance's long-term strategy, which places the ecological and energy transition, support for the competitiveness of regions, the preservation and growth of employment, as well as the support for the development of disadvantaged territories at the heart of its objectives.

Bpifrance tends to actively participate in the development of the Green Bond and Social Bond market by issuing Green & Social Bonds regularly, as we believe those instruments are key financial tools to achieve a low carbon economy and a fair transition.

These bonds are fully aligned with Bpifrance's purpose to create social impact, and to be a natural partner for its stakeholders in addressing environmental issues.

Jean-Yves Caminade, CFO

Bpifrance ESG Rating

Sustainable Bond Program Outstanding : 6.575Bn€

A thematic bond investment program has been incorporated to the Bpifrance’s EMTN program. 6.575Bn€ of long term thematic bond have been issued by Bpifrance. Those thematic bonds are under EPIC guarantee and are rated Aa2 from Moody's & AA- from Fitch. In details:

- Bpifrance’s COVID 19 Response Bond - FR0013510724 – €1.5bn – maturity 26/02/2027

- Bpifrance Inaugural Green Bond - FR0014003C70 – €1.25bn – maturity 25/05/2028 – ICMA Green Bond Principles

- Second Bpifrance Green Bond - FR001400BB83 – €1.25bn – maturity 29/11/2027 – ICMA Green Bond Principles

- Bpifrance Green Bond - FR001400IV17– €1.00bn – maturity 25/05/2033 – ICMA Green Bond Principles

- Bpifrance Inaugural Social Bond - FR001400LPZ1 – €1.575bn – maturity 27/09/2027 – ICMA Social Bond Principles

Bpifrance Green Bond

Updated Bpifrance Green Bond

Bpifrance Green Bond 1&2

Covid 19 Response Bond

Covid 19 Response Bond

Documents related to Bpifrance Covid 19 Response Bond

Social Bond

Bpifrance Social Bond

Documents related to Bpifrance Social Bond